In today’s financial climate, would-be home sellers are caught in a somewhat paradoxical situation: an economy doing well and a strong housing market, but mortgage rates are steadily climbing, now hovering around 7%. For many homeowners, this presents a unique challenge. Over the past few years, unprecedented conditions led to record-low mortgage rates, with many homeowners refinancing their homes at rates of 3.5% or even less. They locked in those low rates, confident they were making an astute, financially savvy move. And indeed, they were.

But now, a new predicament has emerged. Many of these same homeowners are starting to feel the strain of what we’re calling “mortgage lock.” The term refers to homeowners who, after having refinanced at historically low rates, now find themselves feeling tied down or “locked” into their current homes. Moving to a new home would mean giving up their low-rate mortgage and facing the reality of current interest rates, which are nearly double what they were when they last refinanced.

The “mortgage lock” phenomenon is leaving homeowners feeling trapped. Even as life circumstances change – expanding families, new jobs, or just the desire for a change of scenery – many resist the move because of the financial implications. They’re caught between the need or desire to move and the financial discomfort of leaving their low mortgage rate behind.

So what is a homeowner to do if they are contemplating selling and moving up? or moving out of the area?

Stay with us as we explore a potential solution to this dilemma: the 2-1 buydown. This strategic tool might be just what “mortgage locked” homeowners need to break free and reclaim their mobility in the housing market.

In the mortgage landscape, one strategy that has shown promise for homeowners facing the ‘mortgage lock’ dilemma is the 2-1 buydown. A mortgage buydown, in essence, is a financial arrangement in which the buyer (or sometimes the seller) makes an upfront payment to the lender to temporarily reduce the mortgage interest rate for a specified period. In the case of a 2-1 buydown, this rate reduction applies to the first two years of the mortgage.

Here’s how a 2-1 buydown works: In the first year of the mortgage, the interest rate is reduced by 2% below the note rate, the rate agreed upon in the original loan agreement. In the second year, the rate is 1% below the note rate. By the third year, the interest rate reverts to the original note rate for the remainder of the loan term.

Consider an example. Let’s say a homeowner is moving from a previous mortgage rate of 3.5% to a new loan at today’s market rate of 7%. With a 2-1 buydown, their interest rate in the first year would be reduced to 5% (7% – 2%). In the second year, the rate would rise to 6% (7% – 1%). By the third year, it would reach the full 7%.

This strategy effectively reduces the average interest rate from 7% to 5.5% when averaged over the first two years, helping to bridge the gap between the comfortable rate of 3.5% and the higher current rate. The purpose of a 2-1 buydown is to lessen the financial shock of transitioning to a substantially higher mortgage rate. It’s a way to smooth the transition, providing homeowners with a more gradual adjustment to their new financial situation. Let’s delve deeper into the benefits of a 2-1 buydown in the next section.

The 2-1 buydown is a viable solution to combat the sense of “mortgage lock” and the subsequent payment shock. This strategy brings several significant benefits to homeowners looking to move without drastically altering their financial situation.

One of the most notable advantages of a 2-1 buydown is its role in mitigating payment shock. By allowing homeowners to gradually adjust to higher rates, it provides a cushion against a sudden and steep hike in monthly mortgage payments. Instead of jumping directly from a comfortable 3.5% to a considerably higher 7%, homeowners using a 2-1 buydown would start with an interest rate of 5% in the first year. This is a significant reduction compared to the market rate and less of a jolt from the prior 3.5% rate.

In the second year, the interest rate goes up to 6%. While this is still a higher rate than they might have been used to, it is again lower than the current market rate of 7% and is less of a shock than if the rate had jumped to 7% immediately. It’s a softer, more manageable transition that gives homeowners time to adjust to their new financial landscape.

By the third year, the interest rate reaches the full market rate of 7%. At this point, the homeowner will have had two years to adjust to this new financial reality gradually. This incremental adjustment can make the transition far less stressful and more financially manageable.

This approach to dealing with high mortgage rates eases homeowners into their new reality over a period of time rather than forcing an immediate and potentially difficult adjustment. The 2-1 buydown strategy, therefore, is not just about numbers; it’s also about creating an emotionally and financially smoother transition for homeowners facing the prospect of higher mortgage rates.

In the next section, we’ll examine a real-life example of how a 2-1 buydown would work for a homeowner moving from a 3.5% rate to a 7% rate. Let’s dive in!

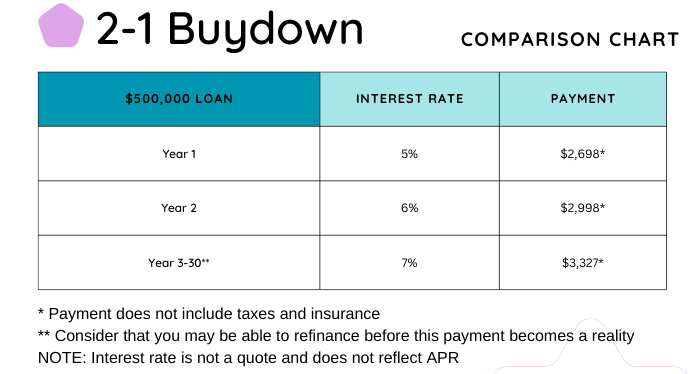

To illustrate how a 2-1 buydown could work for a homeowner, let’s examine a practical example. Imagine a homeowner who is currently paying a 3.5% interest rate on their mortgage. For whatever reason – be it a change in lifestyle, work, or family dynamics – they need to move and face the reality of securing a new mortgage in today’s climate, with interest rates around 7%. Using a 2-1 buydown strategy, this homeowner can gradually transition to the new rate. Let’s consider a $500,000 loan for our example.

In the first year, instead of jumping straight to 7%, the homeowner will have an interest rate of 5% (7% – 2%). Using a standard mortgage calculator, the monthly mortgage payment (principal and interest) for a 30-year loan of $500,000 at a 5% interest rate will be approximately $2,684.

In the second year, the rate will increase to 6% (7% – 1%). With the same loan amount, the monthly mortgage payment at a 6% interest rate will be about $2,998. While this is higher than the payment at the 5% interest rate, it’s still less of a jump than if they had moved directly to the 7% rate.

Finally, in the third year, the rate will adjust to the full 7%. At this rate, the monthly mortgage payment for our $500,000 loan will be around $3,327.

Keep in mind that by this time, the homeowner will have had two years to adjust their budget and financial expectations to this higher payment. There is a good possibility that the homeowner has had an increase in income due to usual annual pay raises, which makes the payment more affordable.

This gradual increase in mortgage payments helps ease the homeowner’s transition from their comfortable 3.5% interest rate to the market rate of 7%. The 2-1 buydown is a strategy that allows homeowners to adjust to new rates over time, mitigating the potential payment shock associated with a sudden leap in mortgage interest rates.

But the strategy doesn’t end here. If we consider the cyclical nature of mortgage rates, we can safely predict that there will be more changes in mortgage rates. Let’s see how this benefits the new homeowner.

While the 2-1 buydown strategy offers a comfortable and manageable pathway to cope with rising interest rates in the short term, there remains another potential long-term solution: refinancing.

Refinancing allows homeowners to take advantage of future reductions in interest rates. This involves replacing the existing mortgage with a new one, which ideally carries a lower interest rate. This could effectively reduce your monthly mortgage payments, the total amount you pay over the life of the loan, or both.

Given the current economic predictions, which we’ve discussed earlier, there’s a possibility that rates could drop back into the 5% range in the future. If this prediction holds true, homeowners could choose to refinance their mortgage at this lower rate. The prospect of securing a new 30-year fixed-rate mortgage in the 5% range might seem attractive to homeowners presently confronting rates around 7%.

Let’s imagine the scenario for the homeowner in our example. After two years of using the 2-1 buydown strategy, and with rates now potentially in the 5% range, they could decide to refinance. They would then lock in a new rate of around 5% or so, substantially reducing their monthly payments compared to the 7% they would otherwise have to pay in the third year of their mortgage.

As with any financial strategy, refinancing should be considered with a thorough understanding of its potential costs and benefits. Refinancing typically involves closing costs and may extend the life of your loan, so it’s vital to evaluate whether refinancing makes sense in your unique financial situation.

Homeownership is a journey filled with change, challenges, but also opportunities. This article has demonstrated that the current high-interest-rate environment need not keep homeowners feeling “mortgage locked.” Instead, strategic approaches, such as the 2-1 buydown, can serve as dynamic solutions, providing an effective pathway to navigate your future needs or plans.

The 2-1 buydown strategy is far more than a temporary fix. It offers homeowners an invaluable chance to soften the potential blow of higher interest rates, providing a gradual adjustment period over the first two years of their new mortgage. This phased approach helps manage immediate financial impacts and prepares homeowners for potential future economic shifts.

So, if you’re feeling “mortgage locked,” it’s time to explore the 2-1 buydown strategy. This approach has the potential to not just alleviate the current financial strain but also pave the way for a more stable and secure homeownership journey.

Embrace the journey of homeownership, with its challenges and opportunities. Don’t let the fear of higher rates keep you “mortgage locked”. Consider the 2-1 buydown strategy, seek advice, and take control of your financial future. After all, owning a home should be about security and comfort, not financial stress.

This article, however, is just a starting point. The path to financial stability and success is often as unique as the individuals walking it. Therefore, seeking professional advice that considers your unique circumstances, goals, and options is crucial. If you are feeling “mortgage locked” give us a call and let’s explore what a 2-1 buydown may do to open up new possibilities of a new home, and still making it affordable for you to move.

Get updates on Whittier Real Estate!