Imagine stepping back in time to 2009, just after the housing market crash. Potential homebuyers in Whittier were likely filled with uncertainty, wondering if purchasing a home was a wise decision. Fast forward to today, and those who took the leap of faith are now reaping the rewards. The average home price in Whittier has skyrocketed by an astonishing 78% over the past 15 years, reaching $848,235 as of May 2024.

Back in 2009, the housing market in Whittier was a different story. The median home price had dropped to around $370,000, and many were hesitant to invest in real estate. However, those who had the foresight and means to purchase a home during that time have seen their investments pay off handsomely.

Fast forward to today, and the Whittier housing market is a completely different ballgame. Despite the challenges posed by low inventory and rising mortgage rates, buyer demand remains strong. Homes are flying off the market at record speeds, with the average days on market dropping from 113 in 2008 to just 29 in May 2024.

So, let’s look at the full picture, drilling down into all the important market statistics you need to know about the Whittier Real Estate market.

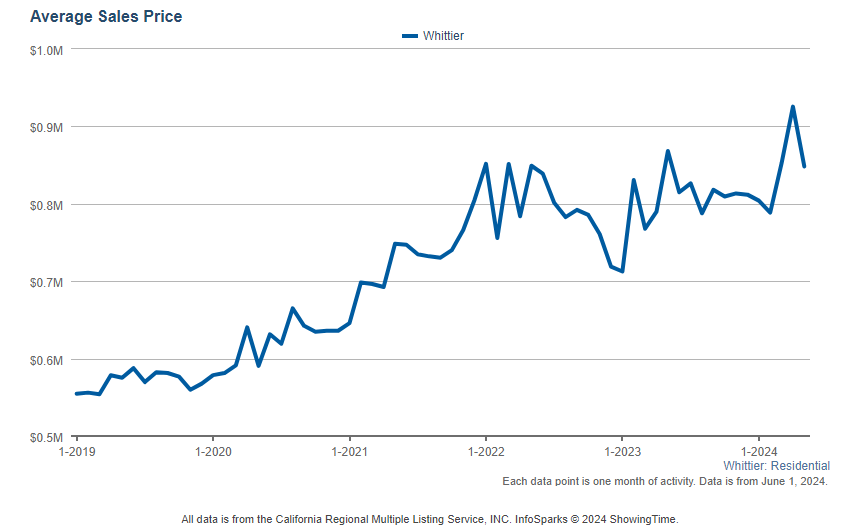

The Whittier real estate market has experienced a remarkable surge in home prices over the past 15 years. The last tive years have been particularly rewarding for those that bought before the recent sharp spike in prices. In may 2019, the average sales price was $575,00 just five years later, that same home is now worth around $850,000 – $275,000 jump in value in five years, or approximately $55,000 a year. This appreciation has been driven by persistent low inventory, strong demand due to Whittier’s desirable location and amenities, and the overall shortage of housing in Southern California.

The Whittier real estate market has experienced a remarkable surge in home prices over the past 15 years. The last tive years have been particularly rewarding for those that bought before the recent sharp spike in prices. In may 2019, the average sales price was $575,00 just five years later, that same home is now worth around $850,000 – $275,000 jump in value in five years, or approximately $55,000 a year. This appreciation has been driven by persistent low inventory, strong demand due to Whittier’s desirable location and amenities, and the overall shortage of housing in Southern California.

As of May 2024, there are 111 pending listings in Whittier, with a median listing price of $875,000. The relationship between pending sales and low inventory has created a highly competitive environment, with buyers often forced to make quick decisions and offer above the asking price. Despite the affordability challenges posed by high mortgage rates, the Whittier market has shown remarkable resilience. Pending sales remain strong, largely due to the severe shortage of available homes for sale.

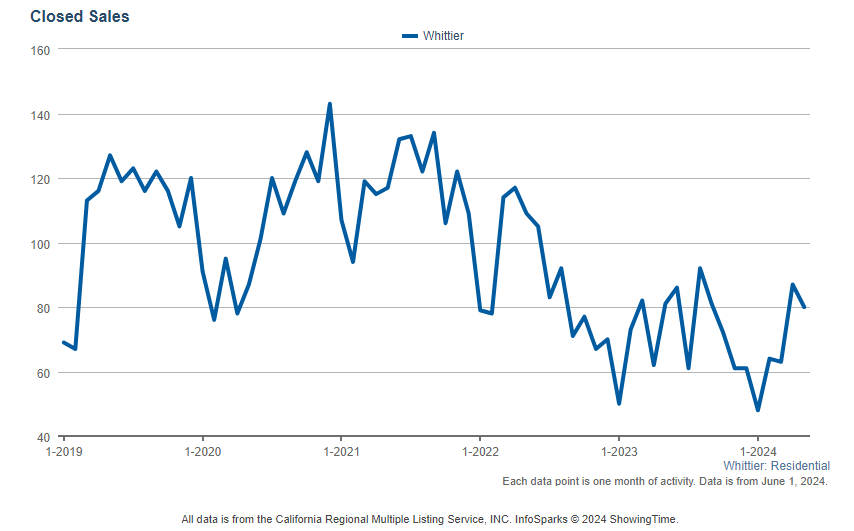

In May 2024, Whittier recorded 80 closed sales, down slightly from the previous month, and the previous year as well. In fact if we look at the past three and five years numbers, we are looking at a significant drop of 37% in sales from May 2019.

In May 2024, Whittier recorded 80 closed sales, down slightly from the previous month, and the previous year as well. In fact if we look at the past three and five years numbers, we are looking at a significant drop of 37% in sales from May 2019.

The decline in sales is due primarily to the shortage of homes for buyers. In small part, higher rates have also played a part.

The number of new listings in Whittier has decreased over time, from around 200-300 per month in 2008 to under 100 per month in recent years. This trend is influenced by factors such as the “lock-in effect,” where existing homeowners are hesitant to list their properties due to concerns about finding replacement homes, and the limited supply of new construction homes.

The number of new listings in Whittier has decreased over time, from around 200-300 per month in 2008 to under 100 per month in recent years. This trend is influenced by factors such as the “lock-in effect,” where existing homeowners are hesitant to list their properties due to concerns about finding replacement homes, and the limited supply of new construction homes.

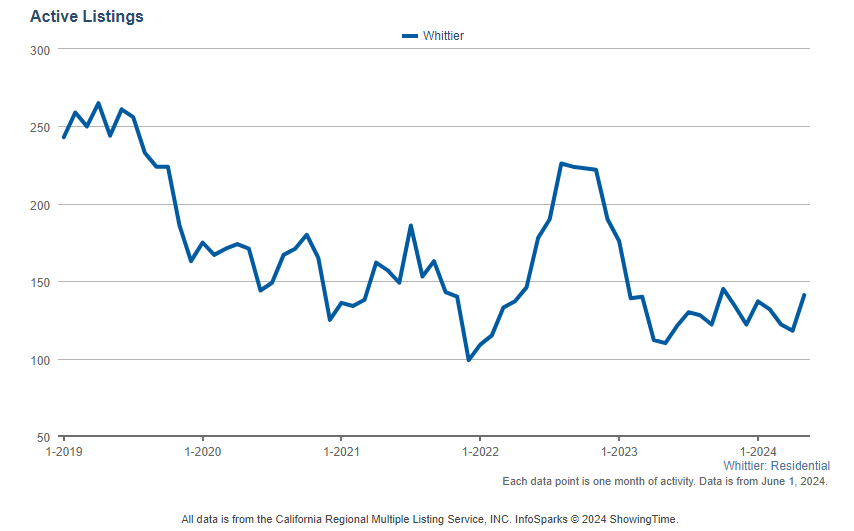

Similarly, the number of active listings in Whittier has seen significant changes over the past 15 years. As of May 2024, there were 141 active listings, a notable increase from the 118 listings recorded in April 2024. However, this figure is still significantly lower than the levels seen in the early 2000s, when active listings consistently exceeded 1,000 properties.

Whittier had a mere 1.4 months of housing inventory as of May 2024, indicating a strong seller’s market where the demand for homes far outpaces the available supply. This low level of inventory has led to homes selling quickly, with the average days on the market dropping to just 29 days in May 2024, a significant decrease from the 113 days recorded in 2008.

Mortgage rates have experienced significant fluctuations in recent years, with the average 30-year fixed mortgage rate climbing from historic lows of around 3% in April 2021 to approximately 7.25% in May 2024. This rapid rise in rates has had a profound impact on affordability, making it more challenging for many potential buyers to enter the market.

To illustrate the impact of higher mortgage rates, consider the mortgage payment on the average-priced home of $575,000 in May 2019 – rates at the time were around 3.5% so the monthly payment was $2,066 for principal and interest. Today, that same house after appreciating $275,000 and mortgage rates going from 3.5% to 7.5% approximately, the payment would come out to $4,755 – Same house, just different time. The payment is 137% higher. And as we all know, wages have not exactly doubles during the same period.

The Whittier real estate market has demonstrated remarkable resilience and growth, despite the challenges posed by low inventory and high mortgage rates. Key findings from our analysis include:

Looking ahead, the outlook for the Whittier real estate market remains positive, albeit with some potential for moderation. Experts predict that home prices in Whittier will continue to rise in the coming years. However, the rapid appreciation of the past few years may give way to a more balanced market, as buyers and sellers adjust to the new normal of higher mortgage rates and limited inventory.

For those considering buying or selling a home in Whittier, it is highly recommended that you work with a local real estate professional who can provide expert guidance and help navigate the current market conditions.

Get updates on Whittier Real Estate!